2025 Mining Revolution Unveiling the Best Btc Asic Miner With 6000 GHs Performance

As we approach the 2025 Mining Revolution, the demand for high-performance cryptocurrency mining solutions continues to surge, making the Btc Asic Miner a focal point of interest for both new and seasoned miners. Recent industry reports indicate that Bitcoin mining efficiency is set to escalate, with predictions suggesting that miners will need to achieve at least 6000 GHs performance to remain competitive in the ever-evolving digital landscape. According to a study by the Cambridge Centre for Alternative Finance, the global Bitcoin mining network power has increased substantially, illustrating a relentless pursuit of innovation and technological advancement. This blog will delve into the essential applications of the latest Btc Asic Miner technology, showcasing real-world use cases, and elaborating on the compelling reasons why investing in these high-efficiency miners is not only a strategic move but a necessary step for long-term sustainability in the cryptocurrency market.

The Rise of 6000 GHs ASIC Miners: A Game Changer for Cryptocurrency Mining

The rise of 6000 GH/s ASIC miners represents a significant turning point in the cryptocurrency mining landscape. As the demand for Bitcoin continues to surge, miners are constantly on the lookout for advanced technology that can provide an edge in performance and efficiency. The introduction of these high-performance ASIC miners not only boosts hash rates but also enhances energy efficiency, allowing miners to maximize their profits while minimizing operational costs.

This new generation of 6000 GH/s miners is particularly appealing as it caters to both seasoned miners and newcomers eager to enter the cryptocurrency space. With improved design and technology, these miners deliver robust performance, ensuring that miners can compete effectively in a rapidly evolving ecosystem. The efficiency gains also contribute to a more sustainable approach to mining, as energy consumption becomes a critical factor for profitability. Overall, the emergence of 6000 GH/s ASIC miners is set to redefine mining strategies and pave the way for a more competitive future in the cryptocurrency industry.

China's Dominance in ASIC Miner Production: Quality and Innovation

China has long held a dominant position in the ASIC miner production market, thanks to its robust manufacturing capabilities and technological innovation. With companies leading the charge, China has managed to capture over 65% of the global market share in bitcoin mining equipment as of 2023. This dominance has allowed the country to control not only production but also pricing in a highly competitive industry. However, recent developments suggest that this trend may be on the verge of significant change.

The Chinese government's crackdown on cryptocurrency trading and mining operations indicates a potential shift in the landscape of bitcoin mining. As facilities face increased scrutiny and production resources are being constrained, companies outside of China see an opportunity to capture market share. For instance, recent news highlighted an American startup preparing to introduce competitive mining equipment to challenge the established Chinese giants. This move could signal the beginning of a more balanced global market, potentially reducing reliance on Chinese production while encouraging innovation, quality, and efficiency in the process. With competitive pressure mounting, the mining equipment sector may soon experience a reshape that favors a more diverse set of players.

2025 Mining Revolution: BTC ASIC Miners Performance Comparison

Evaluating the Performance: How 6000 GHs Miners Compare to Previous Models

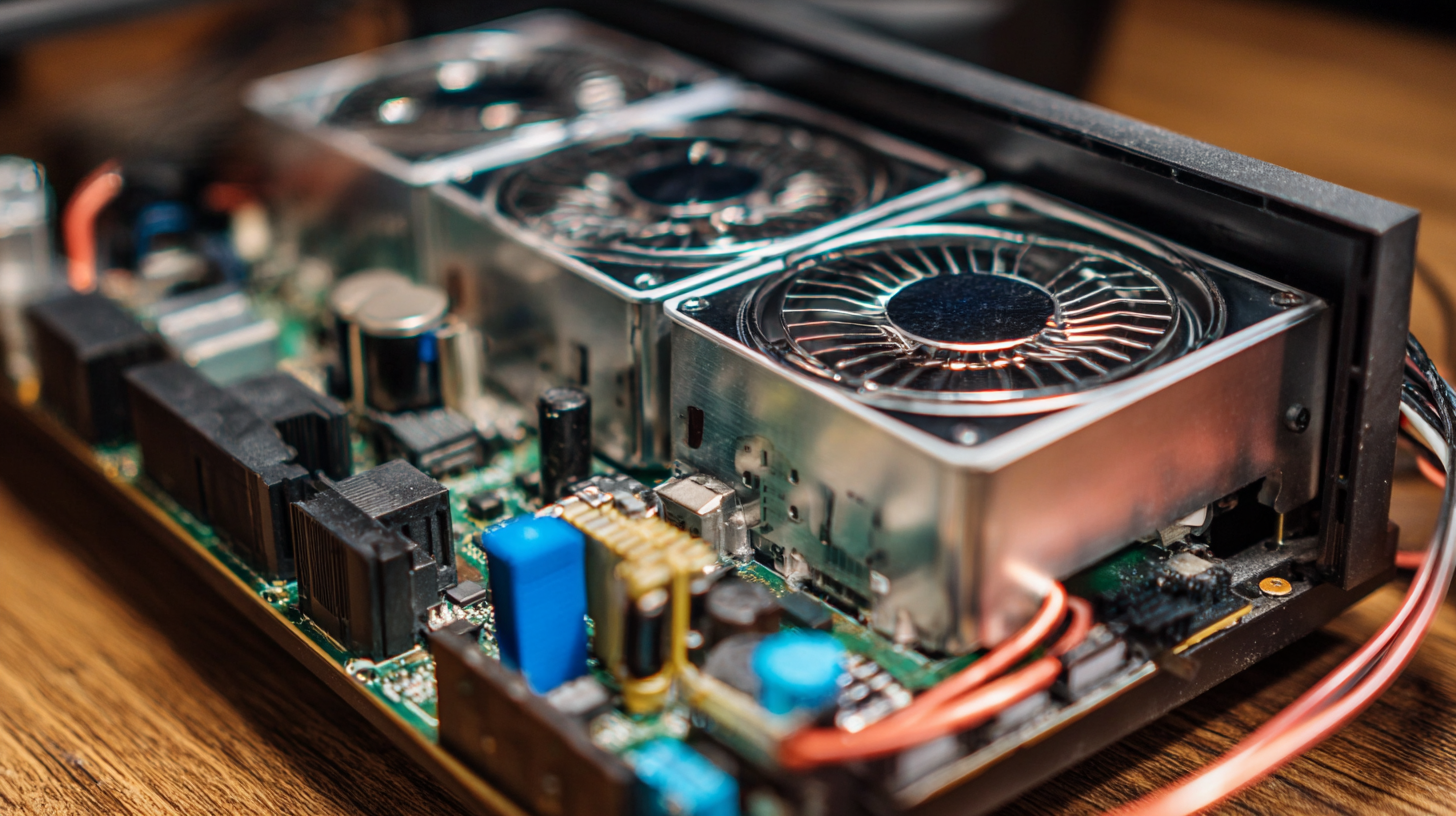

The emergence of the 6000 GHs Bitcoin ASIC miners marks a pivotal moment in the mining revolution of 2025. These miners not only promise unprecedented performance but are also designed to outshine their predecessors significantly. When evaluating the performance of these new entrants, one cannot ignore the rigorous demands of power consumption, heat management, and overall efficiency they must meet compared to older models. Notably, the advancements in technology ensure that the latest models are more sustainable and economically viable for long-term mining operations.

**Tip:** Consider the total cost of ownership when selecting a miner. While initial costs may be higher for advanced 6000 GHs units, efficiency improvements can lead to substantial savings in power consumption over time.

Another critical aspect to analyze is how these miners handle heat, which has been a significant issue in the cryptocurrency mining landscape. With enhanced cooling solutions, the 6000 GHs models are designed to mitigate overheating risks, increasing their reliability and performance longevity.

**Tip:** Look for miners with robust cooling systems, as this can improve the efficiency and lifespan of the equipment, leading to better returns on investment.

The Economic Impact of Advanced ASIC Miners on the Global Bitcoin Market

The rapid evolution of ASIC miners is reshaping the global Bitcoin market, particularly with the anticipated advancements projected for 2025. According to a report from the Cambridge Centre for Alternative Finance, the rise of specialized ASIC miners has significantly improved energy efficiency and hash rates, with leading models reaching up to 6000 GH/s. This leap in performance not only enhances mining profitability but also influences the overall supply dynamics of Bitcoin, which is essential as the currency approaches its cap of 21 million coins.

Moreover, the deployment of advanced ASIC miners has far-reaching economic implications. A recent study published by CoinMetrics estimates that the annual energy consumption of Bitcoin mining could exceed 250 terawatt-hours by 2025, a figure closely tied to the efficiency of new ASIC designs. As miners align their operations with sustainable practices, such as utilizing renewable energy sources, the cost of Bitcoin production could stabilize, thereby impacting its market price. Consequently, these advanced technologies may not only drive profitability for miners but also contribute to the stability of the Bitcoin ecosystem, fostering a more robust economic climate in the cryptocurrency market.

2025 Mining Revolution Unveiling the Best BTC ASIC Miner with 6000 GH/s Performance

| Parameter | Value |

|---|---|

| Hash Rate | 6000 GH/s |

| Power Consumption | 3500 W |

| Efficiency | 0.58 J/GH |

| Cooling Method | Air-Cooled |

| Release Year | 2025 |

| Estimated Price | $5000 |

| Expected ROI (Return on Investment) | 12 months |

| Market Impact | Significant Increase in Hashrate |

Sustainability in Mining: How China is Leading the Charge with Efficient Technologies

As the mining sector evolves, sustainability has become a pivotal focus, particularly with China at the forefront of adopting efficient technologies. Recent developments indicate that China is actively enhancing mining operations in regions like the Democratic Republic of Congo, which boasts vast reserves of copper and cobalt, critical to the global supply chain. By leveraging these rich resources, China not only aims to fulfill its industrial demands but also ensures that mining practices adhere to higher environmental standards.

Moreover, innovations such as electrokinetic technology are revolutionizing rare earth mineral extraction, achieving an impressive 95% recovery rate while minimizing environmental footprints. Such advancements exemplify how the interplay between technology and sustainable practices can reshape the mining landscape. This commitment to sustainability is further reflected in the digital transformation of Chinese mining firms, enhancing their operational efficiency and aligning with global ESG (Environmental, Social, and Governance) expectations. As the world shifts toward greener alternatives, China’s strategic initiatives in responsible mining could set a benchmark for other nations to follow.