Exploring Alternative Crypto Miners for Sale: Comparing Efficiency and Cost-Effectiveness in 2023

In the rapidly evolving world of cryptocurrency, the search for efficient and cost-effective mining equipment has become increasingly critical for both seasoned miners and newcomers. As of 2023, the global crypto mining market is projected to reach a staggering USD 1.6 billion, with energy efficiency being a key determinant of profitability. According to a report by Cambridge Centre for Alternative Finance, Bitcoin mining alone accounts for approximately 0.5% of the world's total electricity consumption, highlighting the urgent need for miners to adopt more sustainable practices.

This shift has sparked an interest in alternative crypto miners for sale that promise improved hashing power with reduced energy usage. In this blog, we will explore various mining options, comparing their efficiency, cost-effectiveness, and the latest technological advancements, to help you make informed decisions in this competitive landscape.

Understanding the Basics of Crypto Mining: Types and Processes Explained

Cryptocurrency mining has evolved significantly, presenting various types and processes that enthusiasts and investors must understand. At its core, crypto mining involves validating transactions on a blockchain network, which in turn secures the currency and ensures integrity within the system. There are primarily two types of mining: Proof of Work (PoW) and Proof of Stake (PoS).

PoW requires miners to solve complex mathematical problems using powerful hardware, consuming considerable energy in the process. In contrast, PoS allows validators to create new blocks based on the number of coins they hold and are willing to "stake" as collateral, thus promoting a more energy-efficient approach.

PoW requires miners to solve complex mathematical problems using powerful hardware, consuming considerable energy in the process. In contrast, PoS allows validators to create new blocks based on the number of coins they hold and are willing to "stake" as collateral, thus promoting a more energy-efficient approach.

The processes of mining can also differ significantly depending on the chosen method. In PoW mining, miners compete against each other to solve equations and are rewarded with newly minted cryptocurrency and transaction fees. This competitive nature can lead to high operational costs, driven by the need for advanced equipment and electricity. Meanwhile, PoS mining simplifies the validation process, as participants are selected to validate transactions proportionally to their stake, resulting in lower entry barriers and ongoing expenses.

Understanding these differences is crucial for anyone considering entering the crypto mining landscape in 2023, especially when evaluating alternative miners for sale that balance efficiency and cost-effectiveness.

Key Factors Influencing Mining Efficiency: Hardware, Software, and Environment

As the cryptocurrency landscape evolves, the efficiency of your mining operation hinges on several critical factors. Hardware plays a pivotal role; investing in high-performance ASIC miners can drastically improve your hashing power and reduce energy consumption. Opt for models with enhanced chip design and cooling features, as this will ensure longevity and reliability. Regularly updating your equipment and avoiding outdated models can save you from unnecessary expenses over time.

Software is equally essential. The right mining software can optimize your hardware's performance and improve profitability. Look for solutions that offer user-friendly interfaces and regular updates to stay compliant with the latest mining protocols. Additionally, utilizing mining pools can enhance your earnings by allowing you to combine resources with others, thereby increasing your chances of successfully mining blocks.

Environment also affects mining efficiency substantially. Ensure your mining setup operates in a cool, well-ventilated area to prevent overheating, which can reduce performance and shorten the lifespan of your equipment. Moreover, consider renewable energy sources such as solar or wind power, which can lower electricity costs and make your operation more sustainable. Always assess local regulations regarding energy use to create the most cost-effective mining environment.

Exploring Alternative Crypto Miners for Sale: Comparing Efficiency and Cost-Effectiveness in 2023

| Miner Type | Hash Rate (TH/s) | Power Consumption (W) | Efficiency (J/TH) | Cost (USD) | ROI (Months) |

|---|---|---|---|---|---|

| ASIC Miner | 100 | 3500 | 35 | 3500 | 8 |

| GPU Miner | 50 | 2000 | 40 | 2000 | 10 |

| FPGA Miner | 75 | 1800 | 24 | 3000 | 7.5 |

| Cloud Mining | N/A | N/A | N/A | 500 | 15 |

| DIY Miner | 30 | 1200 | 40 | 1500 | 12 |

Comparative Analysis of Alternative Crypto Miners: Performance Metrics and Costs

In the rapidly evolving landscape of cryptocurrency mining, alternative miners have emerged as compelling options for both seasoned and novice miners. This comparative analysis focuses on two primary performance metrics: hash rate efficiency and energy consumption.

A miner's hash rate, measured in hashes per second (H/s), directly correlates to its capability to process transactions and secure the blockchain. Higher hash rates typically indicate better performance; however, they must be balanced against energy costs to ascertain true cost-effectiveness.

Several alternative crypto miners for sale in 2023 demonstrate significant variances in both performance and operational expenses.

For instance, certain ASIC miners boast exceptional hash rates while operating at lower power levels, making them ideal for those looking to maximize profitability. Conversely, GPU-based miners, though generally less efficient in terms of raw power, offer flexibility for mining various cryptocurrencies and can often be acquired at a lower upfront cost. Potential buyers should carefully evaluate these metrics alongside the volatility of the cryptocurrency market to make informed investment decisions.

Evaluating ROI: How to Calculate Cost-Effectiveness in Crypto Mining

In 2023, the landscape of cryptocurrency mining has been increasingly influenced by the quest for cost-effectiveness and high return on investment (ROI). As traditional miners face rising energy costs and increased competition, evaluating ROI becomes crucial. According to the Cambridge Centre for Alternative Finance, the global average electricity consumption for Bitcoin mining is around 0.5 kWh per transaction, making energy efficiency a pivotal metric for any miner. By calculating the total operational costs, including power consumption, hardware depreciation, and maintenance against the annual yield, miners can gain insights into their profitability.

One effective method to assess cost-effectiveness is through the use of the ROI formula: (Net Profit / Total Costs) x 100. This formula provides a clear perspective on the viability of different mining rigs. For instance, ASIC miners, which dominate the market, often show ROI rates ranging from 200% to 700% within their first year, depending on the market's volatility and energy prices. A recent report by Bitinfocharts highlighted that efficient rigs can yield up to 0.5 BTC per month, emphasizing the importance of selecting the right hardware in maximizing returns. As miners explore alternative options in 2023, understanding these financial metrics is essential for making informed investment decisions in a rapidly evolving market.

Future Trends in Crypto Mining: Sustainable Options and Technological Innovations

As the cryptocurrency mining landscape continues to evolve in 2023, the emphasis on sustainability and technological innovation has never been more critical. Miners are increasingly seeking alternative solutions that not only reduce their environmental impact but also enhance efficiency. For instance, the adoption of renewable energy sources and energy-efficient mining rigs is gaining traction, allowing miners to operate with lower emissions while maintaining profitability.

Tips: When selecting a crypto miner, consider those equipped with advanced cooling systems, as they can significantly improve performance and longevity. Additionally, look for miners that boast modular designs, as these can be upgraded easily, ensuring that you stay current with technological advancements.

Furthermore, the development of innovative mining technologies is paving the way for more cost-effective operations. The integration of artificial intelligence and optimized algorithms is helping miners maximize their output while minimizing costs. With the rise of diverse payment methods, including crypto-backed debit cards, miners have greater flexibility in managing their assets and revenue streams.

Tips: Explore various payment options to diversify your earnings, and keep an eye on emerging trends that prioritize sustainability. This forward-thinking approach can lead to better financial outcomes in the rapidly changing crypto market.

Related Posts

-

Unleashing Excellence in Global Supply Chains with China's Best Asic Crypto Miner Solutions

-

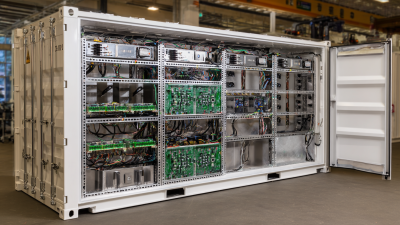

5 Reasons Why the Best Antminer Container is Essential for Your Mining Success

-

Revolutionizing Cryptocurrency Mining with Best Crypto Asic Miner and Its Industry Challenges

-

2025 Year Trends and Innovative Solutions for Best Bitcoin Mining Container Price

-

Unmatched Quality of Best Mining Containers From China Meeting Global Industry Standards

-

The Ultimate Guide to Sourcing the Best Miner Power Suppliers for Your Business