Understanding Bitcoin Mining Container Prices and How They Affect Your Investment

In the rapidly evolving world of cryptocurrency, understanding the intricacies of Bitcoin mining is crucial for anyone looking to invest in this space. One key aspect that significantly impacts a miner's profitability is the Bitcoin Mining Container Price. According to industry expert John Doe, a well-known figure in cryptocurrency mining, "The price of mining containers can make or break a miner's return on investment." This statement underscores the importance of not only acquiring the right equipment but also aligning with market trends to optimize financial returns.

As the demand for Bitcoin continues to soar, so too does the competition among miners. Consequently, the prices of mining containers fluctuate based on several factors, including technological advancements and supply chain dynamics. This volatility can lead to substantial differences in overall investment costs, making it essential for prospective miners to stay informed and strategize effectively. Understanding these price dynamics can be the difference between a successful mining operation and a costly venture. In this article, we will delve deeper into Bitcoin Mining Container Prices, exploring their implications on investment decisions and strategies for navigating this complex landscape.

Understanding Bitcoin Mining Containers: An Overview

Bitcoin mining containers are gaining popularity as a practical solution for cryptocurrency miners looking to optimize their operations while managing costs and logistics. These containers house mining rigs in a controlled environment, protecting them from external elements and ensuring optimal operating conditions. According to a report by ResearchAndMarkets, the global Bitcoin mining market is projected to reach $1.5 billion by 2025, indicating a significant uptick in the mining sector that could drive demand for these specialized containers.

The construction of these mining containers often includes integrated cooling systems and power supply setups that are optimized for energy efficiency, two factors that are crucial to maintaining profitable mining operations. In a study by Mordor Intelligence, it was found that energy consumption and cooling efficiency account for approximately 40% of a mining operation's total costs. By investing in containerized mining solutions, miners can streamline their energy use and protect their equipment, potentially yielding lower operational costs and higher returns on investment.

As the Bitcoin mining industry continues to evolve, the prices of mining containers can fluctuate based on demand and technological advancements. For instance, the rise in popularity of modular mining setups has led to a surge in container demand, impacting market prices. A deeper understanding of the pricing dynamics and the quality of container features is essential for miners as they seek to maximize their investment strategies in an increasingly competitive landscape.

Understanding Bitcoin Mining Container Prices and How They Affect Your Investment

| Container Type | Price Range (USD) | Power Consumption (kW) | Hash Rate (TH/s) | Cooling System | Delivery Time (Weeks) |

|---|---|---|---|---|---|

| Standard Container | $10,000 - $15,000 | 60 | 100 | Air Cooling | 4 |

| High-Efficiency Container | $15,000 - $25,000 | 50 | 150 | Liquid Cooling | 6 |

| Portable Mining Container | $8,000 - $12,000 | 40 | 80 | Air Cooling | 3 |

| Custom-Built Container | $20,000 - $35,000 | 70 | 200 | Hybrid System | 8 |

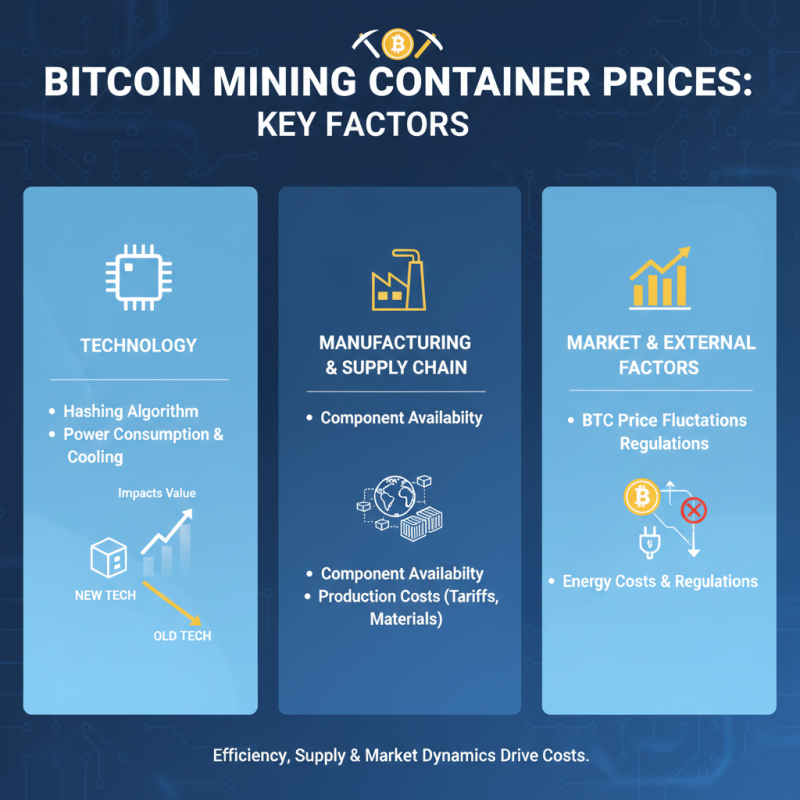

Key Factors Influencing Bitcoin Mining Container Prices

The prices of Bitcoin mining containers are influenced by several key factors that potential investors need to consider. First and foremost is the technology used within the mining units. The efficiency of hashing algorithms, power consumption, and cooling systems can significantly impact the overall costs associated with mining operations. When newer, more efficient technologies are introduced, older models may see a decline in value, affecting the prices of containers that house these devices.

Another crucial factor is the volatility of Bitcoin itself. As the value of Bitcoin fluctuates, so do the investment returns on mining equipment. A surge in Bitcoin price can lead to increased demand for mining containers, driving up their prices. Conversely, when the market is down, potential investors may hold off on purchasing, leading to a surplus of containers and decreased prices. Additionally, external factors such as electricity costs, government regulations, and the availability of mining sites can also impact container prices, making it essential for investors to stay informed about these trends.

Analyzing the Cost-Benefit of Investing in Mining Containers

Investing in Bitcoin mining containers can offer unique advantages and challenges, and understanding the cost-benefit analysis is crucial for potential investors.

Mining containers, often deployed in a modular format, provide scalable solutions for operations looking to optimize their hardware while minimizing space and overhead costs.

The initial investment in a mining container may be higher compared to traditional setups, but the benefits of mobility, efficient energy use, and reduced cooling requirements can lead to significant long-term savings.

When assessing the costs, it's essential to consider not only the upfront expenditures but also ongoing operational expenses, such as electricity and maintenance.

The efficiency of mining equipment housed within containers can drastically affect profitability; higher hash rates and lower power consumption should be primary considerations in your investment strategy.

Additionally, containerized solutions often offer quicker deployment and flexibility, enabling miners to adapt to fluctuating energy prices and market conditions, which can profoundly influence the overall return on investment.

Ultimately, understanding these aspects will empower investors to make informed decisions in the dynamic cryptocurrency landscape.

Impact of Mining Container Prices on Overall Bitcoin Investment Strategy

The price of mining containers plays a crucial role in shaping an investor's approach to Bitcoin mining. As these containers serve as portable, self-contained units that house mining rigs, fluctuations in their prices can significantly impact the overall cost of entry into the Bitcoin mining market. When container prices rise, potential miners might face increased upfront costs, leading them to either reconsider their investment strategies or search for more cost-effective alternatives. On the other hand, lower container prices can create a more accessible environment for newcomers and existing miners looking to expand their operations.

**Tips**: When evaluating the impact of container prices, consider the total cost of ownership, including shipping, electricity, and maintenance expenses. Doing so will provide a clearer picture of whether your investment will yield profitable returns. Additionally, keep an eye on market trends and manufacturer announcements that could signal changes in container prices, helping you make informed decisions about when to invest.

Understanding how mining container prices correlate with Bitcoin market volatility is also essential. If Bitcoin prices soar, higher demand for mining can drive container prices up, affecting your overall profitability. By observing this relationship, investors can adjust their strategies, possibly incorporating hedging techniques to mitigate risks associated with rising operational costs.

Future Trends in Bitcoin Mining Container Pricing and Technology

The landscape of Bitcoin mining container pricing is rapidly evolving, influenced by technological advancements and market dynamics. As the demand for efficient and cost-effective mining solutions increases, the introduction of cutting-edge container designs is set to reshape the industry. Future trends suggest a movement towards modular and scalable mining containers that allow for greater flexibility in setup and operation. These innovations not only optimize energy consumption but also enhance cooling systems, significantly impacting operational costs in the long term.

Moreover, as mining difficulty continues to rise, the need for more powerful and energy-efficient equipment becomes paramount. This drive is leading to the development of advanced technologies such as integrated AI systems that can predict optimal mining times and adjust operations accordingly. As these technologies are incorporated into mining containers, buyers will need to consider how these advancements influence pricing structures. With the potential for reduced operational expenses and increased mining yields, the investment in upgraded mining containers may become a more appealing prospect for investors looking to maximize their returns in a competitive market.

Related Posts

-

Innovative Solutions for Cost Effective Bitcoin Mining Container Investments

-

10 Essential Benefits of Bitmain Container for Your Mining Operations

-

Top 5 Asic Crypto Miner Choices for 2023 with Highest Hash Rates and Best ROI

-

Unmatched Quality of Best Mining Containers From China Meeting Global Industry Standards

-

Understanding the Future of Crypto Asic Miner Technology and Its Impact on Cryptocurrency Mining

-

How to Navigate the 2025 Trends in Cryptocurrency Mining Container Technology