How to Calculate Miner Power for Cryptocurrency Mining?

In the world of cryptocurrency mining, understanding "Miner Power" is crucial. This term refers to the computational strength of mining hardware. According to the Cambridge Centre for Alternative Finance, the global hash rate reached over 200 EH/s in 2023, reflecting the competitive nature of the industry. Expert miner analyst Dr. Alex Robinson states, “Miner Power determines not just efficiency, but profitability in a volatile market.”

The ability to calculate Miner Power can significantly impact mining operations. Accurate assessments allow miners to optimize their energy consumption and improve their return on investment. Yet, achieving this balance is not straightforward. Different algorithms and hardware configurations introduce variability. Many miners struggle with understanding these complexities.

Additionally, external factors like energy prices and regulatory changes often complicate matters. Reflecting on these challenges is important. While there are tools to assist, misunderstandings can lead to poor decisions. As the cryptocurrency landscape evolves, miners must adapt continuously to maintain an edge in efficiency and profitability.

Understanding Miner Power: Key Concepts in Cryptocurrency Mining

Understanding miner power is crucial for anyone involved in cryptocurrency mining. Miner power refers to the computational strength a mining device has. This power determines how quickly transactions are processed and how much cryptocurrency can be earned. Higher miner power can lead to better rewards. However, it comes at a cost.

When assessing miner power, consider several key factors. Hash rate is one of them. It measures how many hashes per second a miner can compute. More hashes mean higher chances of solving complex algorithms and earning rewards. Power consumption is another crucial element. Some miners may use a lot of energy, affecting profitability.

Tips: Monitor your electricity costs regularly. This will help in evaluating the true profitability of your mining operation. Also, research different types of miners. They vary widely in efficiency and power. Find the one that fits your needs best.

Don't forget about cooling systems. Efficient cooling can improve miner performance. Overheating may cause hardware failures, impacting your operations. Always ensure your setup is optimal. Small adjustments can lead to significant gains in efficiency and output.

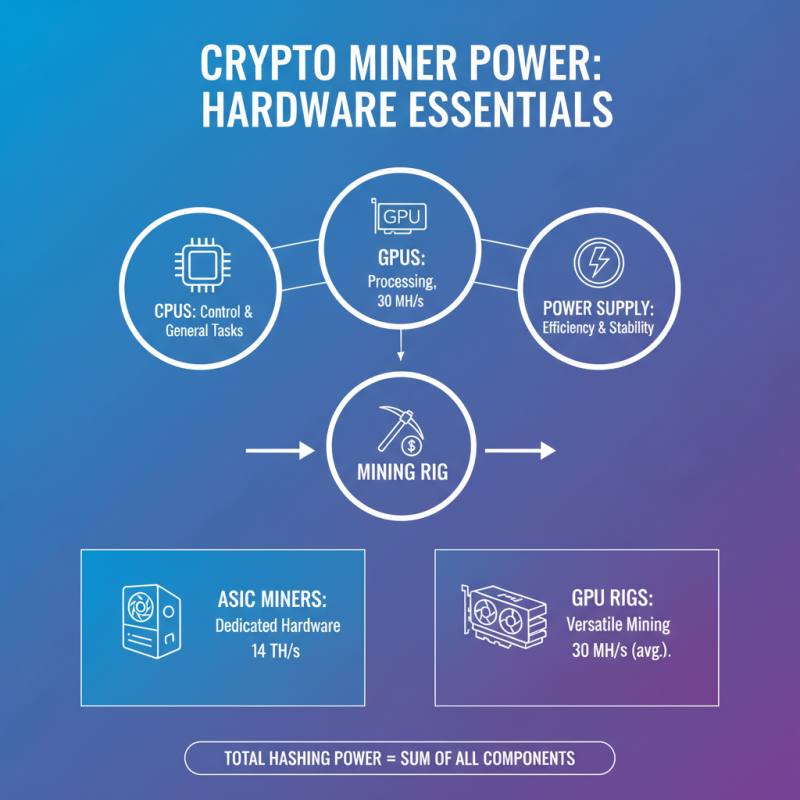

Essential Hardware Requirements for Effective Mining Power Calculation

Calculating miner power for cryptocurrency mining requires understanding the essential hardware. Each component plays a vital role in overall performance. Processors (CPUs), Graphics Processing Units (GPUs), and power supplies must be compatible and efficient. Industry reports suggest that ASIC miners can provide a hashing power of 14 TH/s, while high-end GPUs average about 30 MH/s.

A reliable power supply is crucial. Ensure your PSU meets the wattage needs of your rig. A common rule is to have 20% more wattage than your components require. For instance, if your GPUs need 500W, aim for a PSU rated at least 600W. This prevents overheating and potential damage.

Tips: Consider energy efficiency. Devices with lower wattage consumption save costs in the long run. Additionally, keep your setup cool. High temperatures can throttle performance or damage hardware. Remember, constant monitoring is key. Adjust settings when necessary and ensure that your workspace is optimized for air circulation.

Evaluating Hash Rate: The Core Metric for Miner Efficiency

Evaluating hash rate is crucial for understanding miner efficiency. Hash rate refers to the number of calculations a miner can perform in one second. This metric directly impacts the chances of solving a block and earning rewards. For instance, a miner with a hash rate of 100 TH/s (terahashes per second) has the potential to outperform one with 50 TH/s. Market data shows that the average network hash rate for Bitcoin mining has surged past 200 EH/s (exahashes per second). This dramatic increase indicates rising competition among miners.

A miner's power is not solely dependent on hash rate. Energy consumption plays a significant role. Data suggests that energy efficiency often lags behind advancements in hash rate. High-performance mining rigs may consume 1,500 watts or more. The energy cost can significantly reduce profitability. Miners must evaluate both hash rate and power consumption. A miner might achieve high output but could be challenged by electric bills.

Moreover, fluctuations in network difficulty affect effective mining power. As more miners join the network, the difficulty increases. This can outpace any upgrades in hash rate. Miners need to stay alert to these shifts to maintain profitability. Evaluating and recalibrating their strategy can be essential for long-term success. Understanding these dynamics can help miners make informed decisions.

Calculating Energy Consumption: Power Usage and Cost Implications

Calculating energy consumption for cryptocurrency mining is crucial for profitability. Miners need to understand how much power their equipment uses. This knowledge helps in budgeting expenses and maximizing returns. Most mining rigs consume significant electricity daily, which directly affects costs.

When assessing energy usage, consider the wattage of the mining hardware. For example, a rig using 1,500 watts continuously will consume 36 kilowatt-hours in a day. Multiply this by your local electricity rate to determine daily costs. Miners often overlook fluctuations in energy prices. These variations can significantly impact overall profitability.

It's essential to calculate the potential return on investment and ongoing energy costs. Many miners find themselves surprised by their electric bills. Energy-efficient setups are an option but may not always yield higher profits. Analyzing these factors carefully is vital in making informed decisions. Balancing energy consumption and mining output is an ongoing challenge.

How to Calculate Miner Power for Cryptocurrency Mining? - Calculating Energy Consumption: Power Usage and Cost Implications

| Miner Type | Hash Rate (TH/s) | Power Consumption (W) | Energy Cost per kWh ($) | Daily Energy Cost ($) | Monthly Energy Cost ($) |

|---|---|---|---|---|---|

| ASIC Miner | 90 | 3200 | 0.10 | 7.68 | 230.40 |

| GPU Miner | 35 | 1200 | 0.10 | 2.88 | 86.40 |

| FPGA Miner | 10 | 500 | 0.10 | 1.20 | 36.00 |

| Cloud Mining | N/A | N/A | 0.10 | Varies | Varies |

Assessing Mining Pool vs. Solo Mining: Impact on Miner Power Output

Mining cryptocurrency can be approached in two ways: solo mining or joining a mining pool. Each method has distinct impacts on miner power output. Solo mining allows individuals to keep all rewards but often requires substantial computational power. A report from the Cambridge Centre for Alternative Finance highlighted that only about 1% of miners can effectively profit from solo mining, due to high difficulty levels and competition.

On the other hand, mining pools consolidate resources from multiple miners. This approach increases the chances of earning block rewards, which are then shared among participants. According to recent data, mining pools account for over 75% of the mining industry. This statistic underscores the need for collaboration in a competitive landscape.

Tips: To maximize efficiency, assess your hardware against the mining pool's performance. Evaluate the fees involved and the reward distribution method. Ensure you stay updated on the latest market trends to make informed decisions. Striking a balance between your computational power and the pool's output can lead to better results.

Related Posts

-

The Ultimate Guide to Sourcing the Best Miner Power Suppliers for Your Business

-

2025 Bitcoin Mining Container Market Insights and Essential Strategies for Success

-

Unmatched Quality of Best Mining Containers From China Meeting Global Industry Standards

-

Ultimate Guide to Selecting the Best Crypto Mining Asic Hardware for Maximum Profitability

-

Top 5 Asic Crypto Miner Choices for 2023 with Highest Hash Rates and Best ROI

-

How to Maximize Efficiency with Miner Power Solutions