How to Use Crypto Containers for Secure and Efficient Asset Management in 2025

In the rapidly evolving landscape of digital asset management, the advent of "Crypto Containers" has emerged as a revolutionary solution that promises both security and efficiency. As we approach 2025, the urgent need for robust systems to protect and manage digital assets is more critical than ever. Industry expert Dr. Sarah Thompson, a leading voice in blockchain security, emphasizes the importance of this innovation, stating, "Crypto Containers provide a unique framework that not only safeguards digital assets but also enhances operational efficiency through streamlined processes."

The integration of Crypto Containers into asset management protocols represents a paradigm shift, addressing prevalent concerns around cyber threats and asset volatility. This technology leverages advanced encryption methods and decentralized frameworks, ensuring that users can confidently store and manage their assets without fear of unauthorized access or potential loss. As organizations seek to navigate this new frontier, understanding the functionalities and benefits of Crypto Containers will be essential.

Looking ahead, the adoption of Crypto Containers is poised to redefine asset management strategies, offering a blend of security and efficiency that aligns with the needs of modern investors. By fostering a more secure environment for digital asset transactions, Crypto Containers stand to transform the way businesses and individuals approach asset management in the coming years, pushing the boundaries of innovation in the cryptocurrency space.

Understanding Crypto Containers: Definition and Functionality

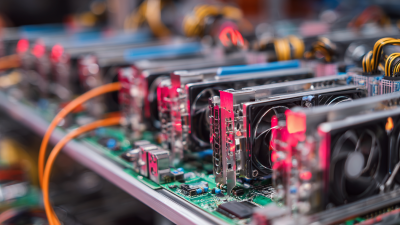

In recent years, crypto containers have emerged as a revolutionary tool for efficient asset management. These digital vaults not only store cryptocurrencies but also facilitate the secure handling of various digital assets. Defined as programmable containers that encapsulate digital assets, crypto containers allow for the seamless integration of functionalities such as automated transactions, smart contracts, and regulatory compliance. According to a 2023 report from the Global Blockchain Consortium, the adoption of crypto containers is projected to increase by 150% over the next five years, emphasizing their growing significance in the digital economy.

For companies looking to harness the power of crypto containers, it's essential to understand their unique functionality. These containers utilize blockchain technology to ensure transparency and security, allowing users to track ownership and transaction history with confidence. Additionally, they support multi-signature functions, adding an extra layer of protection against unauthorized access. As highlighted in a recent industry analysis, nearly 30% of enterprises are expected to implement crypto containers by 2025, showcasing their critical role in the future of asset management.

Tips: When utilizing crypto containers, ensure to implement robust security measures, such as using hardware wallets for sensitive assets. Regularly updating your security protocols can also help mitigate risks associated with cyber threats. Moreover, consider conducting periodic audits of your asset management practices to adapt to evolving market conditions and regulatory requirements effectively.

Key Benefits of Using Crypto Containers for Asset Management

Crypto containers represent a revolutionary approach to asset management, leveraging blockchain technology for enhanced security and efficiency. One of the primary benefits is the immutable nature of transactions recorded on the blockchain. This ensures that all asset transfers and ownership changes are securely documented, significantly reducing the risk of fraud and unauthorized alterations. By utilizing crypto containers, asset managers can maintain a transparent and auditable trail, which is particularly vital in an environment where compliance and regulatory scrutiny are increasing.

Another key advantage of using crypto containers is the increased operational efficiency they provide. Traditional asset management processes can often involve multiple intermediaries, leading to delays and higher costs. Crypto containers streamline these processes by enabling peer-to-peer transactions, reducing the need for middlemen and expediting the transfer of assets. Additionally, the programmable nature of smart contracts can automate various aspects of asset management, such as enforcing contract terms and managing asset liquidity, thereby enhancing overall efficiency and reducing administrative burdens. In a fast-paced financial landscape, these improvements not only optimize asset management but also enable quicker decision-making and response to market changes.

Steps for Setting Up and Managing Crypto Containers

Setting up and managing crypto containers requires careful planning and execution to ensure security and efficiency in asset management. The first step is to select a secure environment for hosting your containers, which may include cloud-based solutions or on-premises servers. Ensure that the environment is properly configured with firewall protections, access controls, and security patches to mitigate potential vulnerabilities.

After establishing a secure environment, the next step is to deploy your crypto containers. This may involve using container orchestration tools to facilitate the management of multiple containers, allowing for easy scaling and management of resources. It is essential to create a robust strategy for monitoring and logging, ensuring all transactions and operations are documented to enhance transparency and accountability.

Tips: Always keep your container images up to date, applying the latest security updates as they become available. Additionally, consider implementing automated backup solutions to protect your assets against data loss. Regularly reviewing your security protocols and access permissions is also crucial; this helps in adapting to any new threats that may arise in the evolving crypto landscape.

Crypto Containers Usage in Asset Management - 2025

Best Practices for Secure and Efficient Use of Crypto Containers

In 2025, the management of digital assets continues to evolve dramatically, and the use of crypto containers has emerged as a best practice for ensuring both security and efficiency. A recent report from Chainalysis indicated that the volume of assets stored in crypto containers grew by 42% in the last year alone, highlighting the significance of adopting such practices for efficient asset management.

To maximize security, it is essential to employ strong encryption protocols when creating and managing these containers. Advanced technology, such as multi-signature wallets and distributed ledger technology, can further enhance the security by requiring multiple approvals for asset access and use.

Another critical aspect is regular auditing and assessment of the crypto containers to identify potential vulnerabilities. According to a survey by Deloitte, 70% of businesses using crypto containers faced challenges related to security threats, primarily due to insufficient monitoring. Implementing real-time tracking and alerts can help mitigate risks associated with unauthorized access. Furthermore, integrating automated solutions for transaction monitoring can significantly reduce the chances of asset mismanagement. As companies increasingly adopt these strategies, they not only protect their digital assets but also foster trust and compliance in the ever-evolving crypto landscape.

Future Trends in Crypto Containers and Asset Management Strategies

As we look towards 2025, the integration of crypto containers within asset management is poised to redefine how institutions and individuals secure and manage their digital assets. A recent report by PwC indicates that the market for crypto assets could exceed $3 trillion by 2025, creating an urgent need for robust and efficient management solutions. Crypto containers—digital vaults that enhance security and operational efficiency—allow for safe storage, transfer, and management of various assets while mitigating risks associated with cyber threats. With the increasing sophistication of hacking techniques, a focus on utilizing crypto containers will be critical for safeguarding investments.

In line with these technological advancements, asset management strategies are evolving to encompass the use of blockchain technology. According to a study by Deloitte, 80% of financial organizations are expected to adopt some form of blockchain in their operations by 2025, with many leveraging crypto containers to enhance transaction transparency and reduce costs. This shift towards decentralized finance (DeFi) models highlights the importance of integrating advanced data analytics and AI tools within crypto containers, enabling asset managers to make more informed decisions while optimizing their portfolio strategies. As market trends shift, staying ahead of the curve with innovative asset management techniques will be essential for both institutional and individual investors.

Related Posts

-

Ultimate Guide: Comparing the Top Bitcoin Mining Containers Available Globally

-

10 Tips for Choosing the Right Asic Mining Rig to Maximize Your Mining Profits

-

Why Container Mining is Set to Revolutionize the Blockchain Industry in 2024

-

China's Leading Export Powerhouse: The Pinnacle of Best Crypto Mining ASICs

-

Revolutionizing Cryptocurrency Mining with Best Crypto Asic Miner and Its Industry Challenges

-

Unlocking the Secrets of Miner Power for Efficient Cryptocurrency Mining