Exploring the Future of Bitcoin Containers: Secure Your Cryptocurrency in a Digital Vault

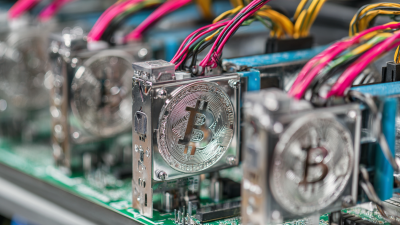

As the cryptocurrency landscape continues to evolve, the emergence of Bitcoin Containers offers a promising solution for securely managing digital assets. According to a recent report by Statista, the number of Bitcoin wallet users is projected to reach 50 million worldwide by 2025, underscoring the growing demand for enhanced security measures. Bitcoin Containers serve as a digital vault designed to protect cryptocurrencies from emerging threats, including malware and phishing attacks. With the global cryptocurrency market capitalization expected to exceed $10 trillion by the end of 2023, ensuring that investors can safeguard their assets has never been more crucial. This article delves into the future of Bitcoin Containers, exploring their functionality, advantages, and the technological innovations that set them apart in the quest for a secure cryptocurrency storage solution.

The Significance of Bitcoin Containers in Modern Cryptocurrency Management

In today's digital landscape, the significance of Bitcoin containers cannot be overstated. As cryptocurrency continues to gain traction, the need for secure storage solutions has become paramount. Bitcoin containers act as digital vaults, safeguarding cryptocurrencies from potential theft and loss. With the rise of sophisticated cyber threats, utilizing a reliable Bitcoin container ensures that investors can manage their digital assets with confidence.

Moreover, the operational dynamics of Bitcoin mining facilities highlight the importance of efficient data management in the cryptocurrency realm. These mining farms function as critical infrastructures, emphasizing the need for a secure and resilient environment where Bitcoin can be stored and managed. As financial technology (fintech) evolves, automatizing financial processes, it intertwines closely with the management strategies of cryptocurrency. A robust Bitcoin container can facilitate smoother transactions and enhance overall security for users navigating the complexities of modern finance.

Tips: Always choose a Bitcoin container that offers two-factor authentication and a secure recovery process. Regularly update your security measures and stay informed about the latest developments in cryptocurrency safety practices. Also, consider diversifying your storage options to further protect your assets against unforeseen events.

Understanding the Mechanics of Digital Vaults for Enhanced Security

The rapid evolution of the cryptocurrency landscape has prompted an increased focus on the security measures surrounding digital assets. Digital vaults, which offer enhanced protection for cryptocurrencies like Bitcoin, are becoming increasingly essential for both individual investors and institutions. These vaults utilize cutting-edge encryption and multi-signature technology to safeguard assets from cyber threats and unauthorized access. Notably, a recent report indicates that 90% of cryptocurrency theft occurs due to breaches in security measures, emphasizing the need for secure storage solutions.

As the market matures, services like Vultisig are emerging, offering institutional-grade security designed to mitigate risks associated with phishing attacks and potential financial losses. The importance of safeguarding digital assets cannot be overstated, as these assets often represent significant financial investments. Implementing robust security measures is crucial; for instance, keeping private keys offline and utilizing biometric access to vault systems are effective methods to enhance protection.

Tips: Always use two-factor authentication when accessing digital vaults. Regularly update your passwords and consider rotating them periodically to reduce the risk of breaches. As the world of digital assets continues to grow, adapting to the latest security technologies becomes paramount in ensuring the safety of your investments.

Comparative Analysis: Hardware Wallets vs. Software Wallets

When it comes to securely storing cryptocurrencies like Bitcoin, choosing between hardware wallets and software wallets is crucial. Hardware wallets, physical devices that store your private keys offline, offer a high level of security against online threats. They are less vulnerable to malware and phishing attacks since they are not connected to the internet. This makes them an excellent choice for long-term investors looking to protect their assets from potential cyber threats.

On the other hand, software wallets provide greater convenience and accessibility, allowing users to manage their Bitcoin quickly from their computers or mobile devices. They come in various forms, such as desktop applications, web-based services, and mobile apps. However, this convenience comes with a trade-off: software wallets are more susceptible to hacking and security breaches if not properly secured. Ultimately, the choice between hardware and software wallets depends on the user’s needs—whether prioritizing security over convenience or vice versa.

Best Practices for Securing Your Cryptocurrency Assets

In the rapidly evolving cryptocurrency landscape, securing your digital assets is paramount. According to recent industry insights, approximately 60% of crypto investors rank security as their top concern when managing their assets. With the rise of cyber threats and attacks, adopting best practices for cryptocurrency security is crucial for ensuring the safety of your investments. Utilizing both hot and cold wallets provides a balance between accessibility and security; cold wallets, which are offline, offer greater protection against hacks, while hot wallets enable quicker transactions.

Establishing a robust security culture is vital, as outlined by experts in the field. Organizations should educate their teams on potential threats and encourage the adoption of multifactor authentication, regular software updates, and secure backup procedures. Moreover, understanding the legal landscape surrounding cryptocurrency forfeiture is essential, as updated frameworks now allow governments to retain forfeited assets as long-term holdings. By instilling comprehensive security practices and staying informed about industry trends, individuals and organizations can effectively safeguard their cryptocurrency investments against the escalating risk environment.

Future Trends in Bitcoin Container Technology and Security Features

As the world of cryptocurrency evolves, the technology surrounding Bitcoin containers continues to advance, emphasizing enhanced security features. Future trends suggest that digital vaults will increasingly incorporate biometric authentication methods, such as fingerprint scanning and facial recognition. This makes unauthorized access nearly impossible, providing users with peace of mind for their valuable assets. Additionally, the integration of multi-signature wallets will gain traction, requiring multiple confirmations before any transactions can be executed, further securing user funds.

Tips: When selecting a Bitcoin container, always prioritize those with robust encryption protocols. Look for platforms that offer end-to-end encryption to ensure your private keys remain secure from potential attackers.

Another crucial trend is the rise of decentralized storage solutions. Unlike traditional wallets that rely on a single point of failure, these solutions distribute data across a network, minimizing risks associated with hacks or system failures. As users become more aware of privacy concerns, implementing secure communication channels, such as VPNs, will also become essential for conducting transactions safely in an increasingly digital landscape.

Tips: Regularly update your wallet software and maintain strong, unique passwords to fortify your digital vault against hacking attempts.

Future Trends in Bitcoin Container Technology

This chart illustrates the importance of various trends in the future of Bitcoin container technology. As security remains the top priority, user convenience and integration with hardware are also crucial for wider adoption. Multi-signature support and regulatory compliance play significant roles in ensuring safe and responsible cryptocurrency management.

Related Posts

-

2025 Mining Revolution Unveiling the Best Btc Asic Miner With 6000 GHs Performance

-

Top 5 Best ASIC Crypto Miners Compared: Which One Reigns Supreme?

-

Exploring the Advantages of Cryptocurrency Mining Containers for Optimal Efficiency

-

Innovative Solutions for Sourcing the Best ASIC Mining Rig Globally

-

10 Tips for Choosing the Right Asic Mining Rig to Maximize Your Mining Profits

-

Top 5 Asic Crypto Miner Choices for 2023 with Highest Hash Rates and Best ROI