Ultimate Guide to Selecting the Best Btc Asic Miner for Your Cryptocurrency Needs

As the cryptocurrency market continues to expand, the importance of selecting the right equipment for mining cannot be understated. Among the various options available, the Btc Asic Miner stands out as a crucial choice for those looking to maximize their profitability. According to recent reports by Bitmain, the global cryptocurrency mining market is projected to grow substantially, reaching an estimated value of $6.83 billion by 2026, largely driven by the increased demand for more efficient mining solutions. Moreover, the efficiency of mining equipment plays a significant role in determining the overall success of mining operations; ASIC miners, specifically designed for Bitcoin extraction, exhibit a striking energy consumption to performance ratio. As the competition intensifies, understanding the nuances of selecting the best Btc Asic Miner is essential for miners seeking to enhance their returns and stay ahead in this rapidly evolving industry.

Key Factors to Consider When Choosing a BTC ASIC Miner

When selecting the best BTC ASIC miner for your cryptocurrency needs, several key factors come into play. One of the most crucial considerations is the hash rate, which determines how quickly a miner can solve blocks and earn rewards. According to a recent report from Bitmain, top-tier ASIC miners can reach hash rates upwards of 120 TH/s, significantly boosting your chances of profit. Additionally, energy efficiency is vital; miners should aim for a model that offers the best hash rate per watt to minimize electricity costs. The latest models show efficiency ratings as low as 30 J/TH, meaning less waste and more profit potential.

**Tips:** Always compare different miners’ specifications and conduct a break-even analysis based on current Bitcoin prices and electricity rates in your area. Additionally, consider the miner's durability and warranty options, as a reliable model can save you significant costs in the long run.

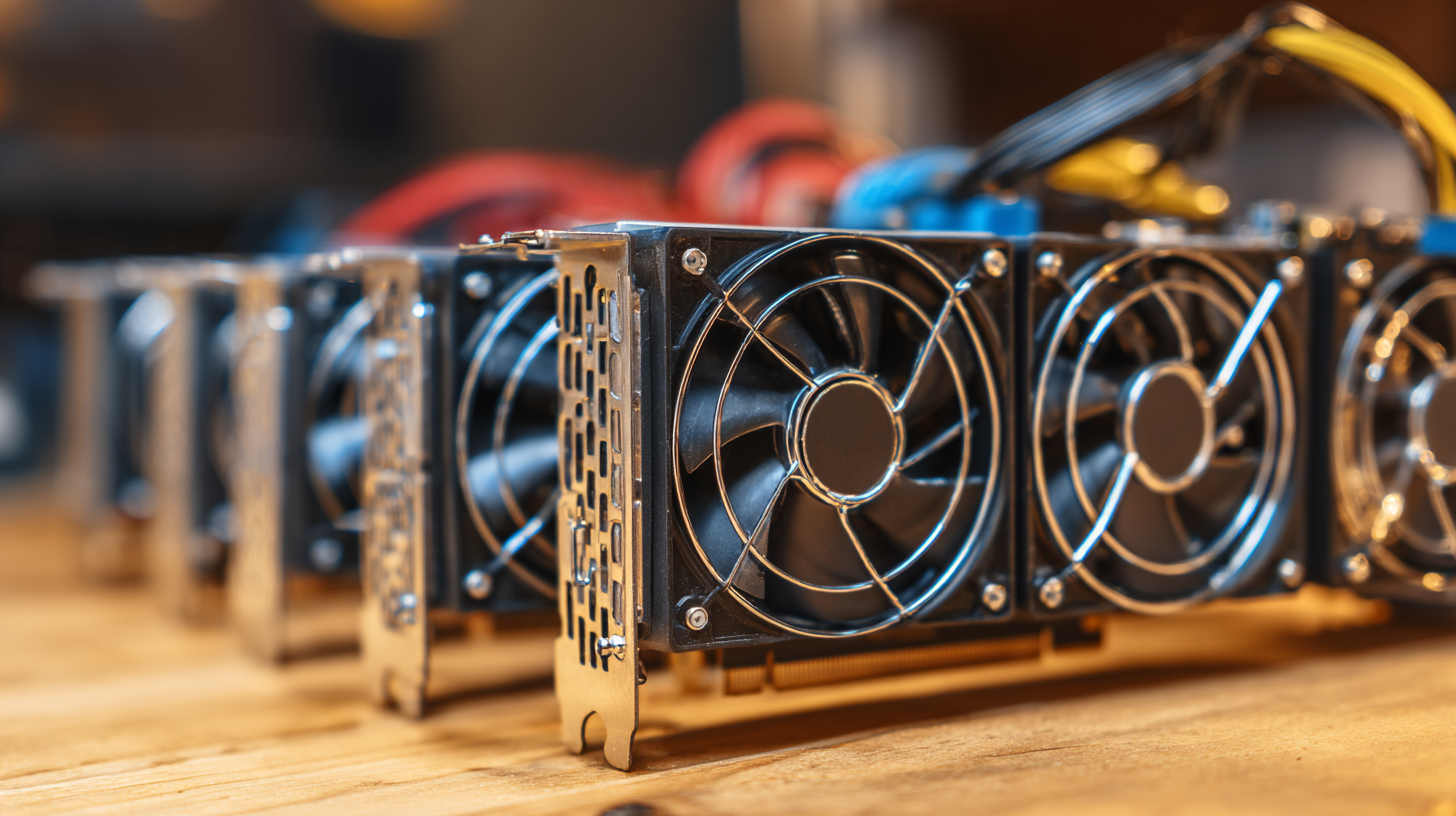

Another essential aspect is the cooling solutions in place, as overheating can reduce performance and lifespan. Efficient cooling mechanisms can be found in high-quality models, which often utilize advanced temperature management systems. Recent evaluations suggest that miners with optimized airflow can operate effectively in ambient temperatures up to 40°C without performance loss.

**Tips:** Look for ASIC miners that offer integrated cooling solutions or recommend external cooling options. This can enhance performance and help to ensure your investment remains profitable.

Comparison of Key Factors in BTC ASIC Miners

Understanding Hash Rate and Its Impact on Mining Efficiency

When selecting the best BTC ASIC miner, understanding the hash rate is crucial, as it directly impacts mining efficiency. Hash rate, measured in hashes per second (H/s), indicates how many calculations a miner can perform in a given time. According to recent industry reports, the latest ASIC miners boast impressive hash rates, with some models reaching over 100 TH/s (terahashes per second). This staggering performance not only enhances the chances of solving complex blocks but also maximizes rewards in an increasingly competitive mining environment.

In addition, the efficiency of a miner can be evaluated by its power consumption, generally expressed in watts per terahash (W/TH). Studies have shown that modern ASIC miners are achieving efficiencies as low as 30 J/TH (joules per terahash), significantly reducing electricity costs. As electricity accounts for a substantial portion of mining expenses, choosing an ASIC with a higher hash rate and lower energy consumption can lead to better profitability. As the cryptocurrency market continues to evolve, miners must keep pace with these technological advancements to maintain a competitive edge.

Ultimate Guide to Selecting the Best Btc Asic Miner for Your Cryptocurrency Needs - Understanding Hash Rate and Its Impact on Mining Efficiency

| Model | Hash Rate (TH/s) | Power Consumption (W) | Efficiency (J/TH) | Cooling Type |

|---|---|---|---|---|

| Miner A | 110 TH/s | 3300 W | 30 J/TH | Air Cooled |

| Miner B | 120 TH/s | 3400 W | 28.33 J/TH | Water Cooled |

| Miner C | 100 TH/s | 3200 W | 32 J/TH | Air Cooled |

| Miner D | 140 TH/s | 3600 W | 25.71 J/TH | Air Cooled |

Evaluating Energy Consumption and Cost-Effectiveness of Miners

When selecting the best BTC ASIC miner for your cryptocurrency needs, evaluating energy consumption alongside cost-effectiveness is crucial. ASIC miners are specifically designed to optimize Bitcoin mining, but their efficiency can vary significantly. A miner's power consumption is not only reflected in its operational costs but also influences its overall profitability. To maximize gains, it is essential to compare different models based on their hash rates and the amount of electricity they consume. Look for miners that offer high hashing power with optimal energy usage, as these will minimize overhead costs and enhance return on investment.

Furthermore, understanding the cost of electricity in your region is vital. Some ASIC miners may have a lower initial purchase price but could lead to higher electricity bills, ultimately impacting your profitability. Calculate the potential earnings from mined Bitcoin versus the energy costs over time. Additionally, consider the long-term sustainability of the miner. A more energy-efficient model may have a higher upfront cost but can pay off over time through lower operational expenses. Balancing the initial investment against ongoing costs will help you select the most effective miner for a successful crypto venture.

Comparing Popular BTC ASIC Miners on the Market Today

When diving into the world of cryptocurrency mining, selecting the right Bitcoin ASIC (Application-Specific Integrated Circuit) miner can make all the difference in maximizing your profitability and efficiency. Today, the market offers a variety of popular BTC ASIC miners, each showcasing unique features that cater to different mining needs. For instance, the Antminer S19 Pro, renowned for its impressive hash rate and energy efficiency, remains a top contender for both seasoned miners and newcomers alike. It delivers a hash rate of around 110 TH/s, making it a powerhouse for those seeking maximum performance.

On the other hand, the MicroBT Whatsminer M30S++ also stands out, with its competitive hash rate and lower power consumption. Boasting around 112 TH/s, this model is favored by many for its reliability and durable build. Moreover, miners should consider factors such as power efficiency, initial investment cost, and long-term profitability when comparing these devices. Evaluating aspects like the miner's cooling capacity and noise levels also becomes essential, as they can influence your mining setup's feasibility, especially in residential areas. By weighing these attributes, miners can make informed decisions tailored to their specific requirements and goals in the cryptocurrency landscape.

Assessing Manufacturer Reputation and Customer Support Services

When choosing the best BTC ASIC miner for your cryptocurrency endeavors, assessing the manufacturer’s reputation and customer support services is crucial. A strong reputation often indicates a track record of delivering quality products and reliable performance. It's essential to research the manufacturer’s history in the industry, paying attention to reviews and feedback from fellow miners. Established brands typically demonstrate a commitment to innovation and consistency, ensuring that their products can withstand the rapidly evolving landscape of cryptocurrency mining.

Equally important is the level of customer support provided by the manufacturer. In the world of cryptocurrency mining, technical issues can arise unexpectedly, making prompt and effective support vital for maintaining operations. Look for companies that offer comprehensive support options, including dedicated help desks, live chat, and extensive online resources such as FAQs and troubleshooting guides. Checking the response times and customer service ratings can give you valuable insights into how well a manufacturer stands behind its products, ensuring you receive assistance when you need it most.