Ultimate Guide to Selecting the Best Crypto Mining Asic Hardware for Maximum Profitability

In the ever-evolving landscape of cryptocurrency, the quest for profitability through efficient mining is more crucial than ever. As the cryptocurrency market continues to expand, reports indicate that Bitcoin mining alone accounted for over $15 billion in revenue in 2021, underscoring the financial opportunities available to miners. However, with the increasing complexity of mining algorithms and energy costs, selecting the right hardware has become a crucial decision for aspiring miners.

Crypto Mining Asic hardware, with its tailored architecture optimized for the intense demands of cryptocurrency computation, plays a pivotal role in maximizing profitability. According to recent industry studies, ASIC miners can achieve hash rates that are several times greater than traditional GPU mining setups, making them indispensable for those looking to gain a competitive edge in the market. This ultimate guide aims to equip you with the knowledge and insights necessary to select the best Crypto Mining Asic hardware and enhance your mining profitability.

Understanding ASIC Hardware: How Technology Impacts Mining Efficiency

When it comes to cryptocurrency mining, Application-Specific Integrated Circuits (ASICs) have revolutionized the landscape by offering unparalleled efficiency and profitability. ASIC miners are designed for a single purpose, which allows them to outperform general-purpose hardware like GPUs in terms of both speed and energy consumption. For instance, a top-tier ASIC miner, such as the Bitmain Antminer S19 Pro, can deliver a hash rate of around 110 TH/s while consuming approximately 3250W of power, resulting in an impressive efficiency of about 29.5 J/TH. This stark contrast highlights how the right technology can significantly enhance mining operations.

Moreover, the impact of mining hardware advancements on profitability cannot be overstated. According to a recent report by the Cambridge Centre for Alternative Finance, the global Bitcoin hash rate has grown exponentially, increasing from around 7.5 EH/s in early 2020 to nearly 200 EH/s by late 2022. Such robust growth in hash rates indicates that miners need to invest in the latest ASIC technology to stay competitive and maximize returns. In environments with rising energy costs, the efficiency of ASIC hardware becomes even more critical, as it directly influences operational expenses and overall profitability. By leveraging ASIC technology, miners can effectively improve their bottom line in an increasingly challenging market.

Comparing Hash Rates: Choosing the Right ASIC for Your Mining Goals

When diving into the world of cryptocurrency mining, understanding hash rates is crucial for maximizing profitability. The hash rate, expressed in hashes per second (H/s), represents the number of calculations a miner can perform in a given time frame. Each ASIC (Application-Specific Integrated Circuit) miner comes with its unique hash rate, and selecting a device that aligns with your mining goals can significantly affect your returns. For example, those seeking to mine Bitcoin will need a different hashing power than someone aiming to mine less-known altcoins.

To choose the right ASIC for your mining aspirations, it's essential to compare the hash rates of various models. Look for devices with high hash rates but also consider their power consumption, as this will directly impact your profitability. ASIC miners with better energy efficiency can reduce operational costs, enabling you to retain more earnings.

Researching and comparing the hash rates of popular ASIC miners on the market will provide insights that help you make an informed decision, ensuring that your investment yields maximum returns in the competitive landscape of crypto mining.

Evaluating Power Consumption: Maximizing Profitability in Mining Operations

When venturing into crypto mining, evaluating power consumption is crucial for enhancing profitability. The energy costs associated with mining operations can significantly impact your bottom line, making it essential to select ASIC hardware that balances performance and efficiency. High hashrate devices may promise speedy processing, but if they drain power excessively, the reduced profit margins can quickly negate any potential gains.

To maximize profitability, miners should focus on the efficiency rating of ASIC miners, often expressed in Joules per Terahash (J/T). This measurement indicates how much power is required for each terahash of computational power generated. Selecting hardware with a lower J/T rating ensures that miners can operate within their energy budget while maintaining competitive mining speeds. Additionally, monitoring local electricity rates and utilizing renewable energy sources can further enhance profitability by reducing overall power expenditure, making informed hardware choices even more vital in the pursuit of successful mining operations.

Power Consumption vs. Profitability of Crypto Mining ASICs

Market Trends: Forecasting ASIC Hardware Demand and Price Fluctuations

As cryptocurrencies continue to dominate the financial landscape, the demand for Application-Specific Integrated Circuit (ASIC) mining hardware is on the rise. According to a recent report by CoinDesk, ASIC miner shipments are expected to increase by 30% annually over the next five years, driven by the surging interest in Bitcoin and other cryptocurrencies. This growth is particularly relevant as market trends indicate that miners are seeking more efficient hardware to maximize profitability. As the complexity of mining algorithms increases, investing in the right ASIC hardware becomes critical for staying competitive.

Price fluctuations in the ASIC hardware market are also a significant concern for miners. A study by Deloitte forecasts that the prices of ASIC miners will remain volatile, correlating closely with Bitcoin's market value. For instance, the average price of high-performance ASICs surged by 45% during the first quarter of 2023 due to increased demand and limited supply. Miners must navigate these price swings strategically to ensure their investments yield optimal returns, making market forecasting a vital component in selecting the right hardware. By understanding these trends and establishing a proactive purchasing strategy, miners can safeguard their profitability against the uncertainties of the cryptocurrency market.

Long-Term Viability: Assessing Mining ROI Amidst Evolving Crypto Regulations

As the cryptocurrency landscape continues to evolve, assessing the long-term viability of mining operations amidst changing regulations has become crucial for miners aiming to maximize return on investment (ROI). According to a recent report from the Cambridge Centre for Alternative Finance, Bitcoin mining absorbed approximately 0.55% of the world's electricity consumption in 2022, highlighting both the energy demands and environmental implications of this industry. As governments introduce stricter regulations regarding energy use and carbon emissions, miners must evaluate the efficiency and legality of their operations to ensure sustained profitability.

Moreover, a study from the Block Research indicates that the average break-even cost for Bitcoin mining has risen significantly due to fluctuating energy prices and hardware costs, now estimated at around $10,000 per Bitcoin. This spike emphasizes the importance of selecting advanced ASIC hardware that not only enhances processing power but also offers energy efficiency. Miners must strategically invest in state-of-the-art equipment that complements evolving regulatory frameworks while also optimizing their operational costs to navigate potential risks associated with regulatory changes effectively.

Related Posts

-

The Ultimate Guide to Sourcing the Best Miner Power Suppliers for Your Business

-

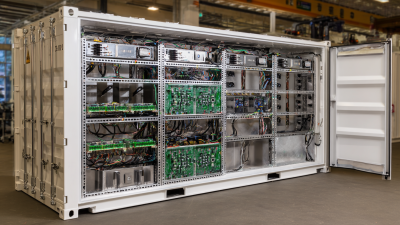

2025 Bitcoin Mining Container Market Insights and Essential Strategies for Success

-

Exploring the Most Innovative Asic Mining Rig Designs of 2023

-

5 Reasons Why the Best Antminer Container is Essential for Your Mining Success

-

7 Proven Reasons to Invest in Container Bitcoin Mining for Your Business Success

-

Unveiling the Technical Specifications of Top Notch Asic Mining Equipment at the Best Asic Mining Shop