Unlocking the Future of Cryptocurrency with Asic Mining Rig Technology

The cryptocurrency landscape is rapidly evolving, driven by technological advancements that promise to enhance mining efficiency and profitability. A pivotal innovation in this realm is the Asic Mining Rig, a specialized hardware designed for optimal performance in mining operations. According to a report by MarketsandMarkets, the global ASIC miners market is expected to grow from USD 1.2 billion in 2021 to USD 9.6 billion by 2026, at a CAGR of 52.6%. This explosive growth highlights the increasing reliance on ASIC mining rigs for producing cryptocurrency with greater speed and lower energy consumption compared to traditional mining methods. As the industry continues to mature, the focus on energy efficiency and sustainable mining practices will be paramount, positioning ASIC technology as a key player in unlocking the future of cryptocurrency.

Benefits of ASIC Mining Rigs in Cryptocurrency Operations

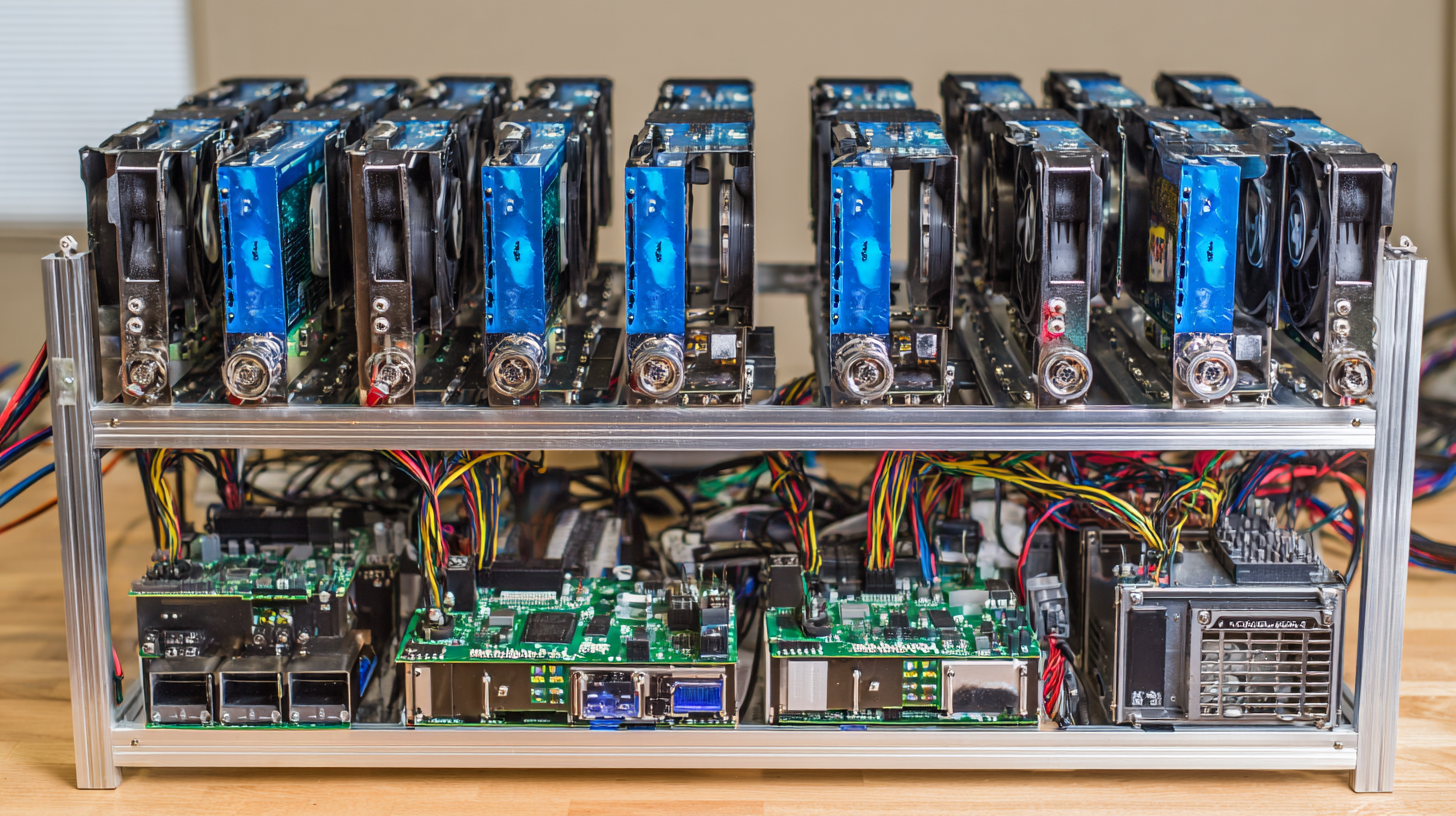

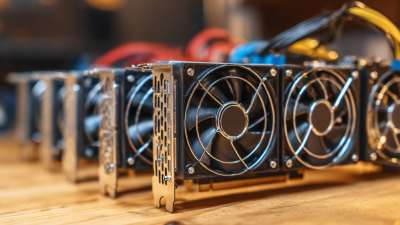

ASIC mining rigs play a pivotal role in optimizing cryptocurrency operations, offering several advantages that boost efficiency and profitability. These specialized machines are designed to perform specific computations required for mining, making them substantially more powerful than general-purpose hardware. This targeted approach allows miners to achieve higher hash rates while consuming less energy, a crucial factor considering the rising cost of electricity that must be factored into mining profitability.

In the evolving landscape of cryptocurrency mining, the introduction of new ASIC models and production capabilities enhances the competitive edge for miners. The shift towards local production by major manufacturers is a strategic response to external pressures, ensuring quicker access to the latest technology and better support for domestic operations. As mining becomes increasingly difficult, the continuous advancement in ASIC technology not only aids in maintaining profit margins but also ensures that miners are better equipped to adapt to market changes and regulatory landscapes.

Understanding How ASIC Mining Tech Enhances Efficiency

ASIC (Application-Specific Integrated Circuit) mining rigs represent a significant advancement in cryptocurrency mining technology, primarily due to their high efficiency compared to general-purpose hardware. Unlike traditional GPUs that can handle a variety of tasks, ASICs are designed with a singular focus on mining specific cryptocurrencies, which allows them to outperform their predecessors dramatically. This specialization enables miners to process complex algorithms at unprecedented speeds while consuming significantly less energy, addressing two of the most critical challenges in the mining industry: cost and efficiency.

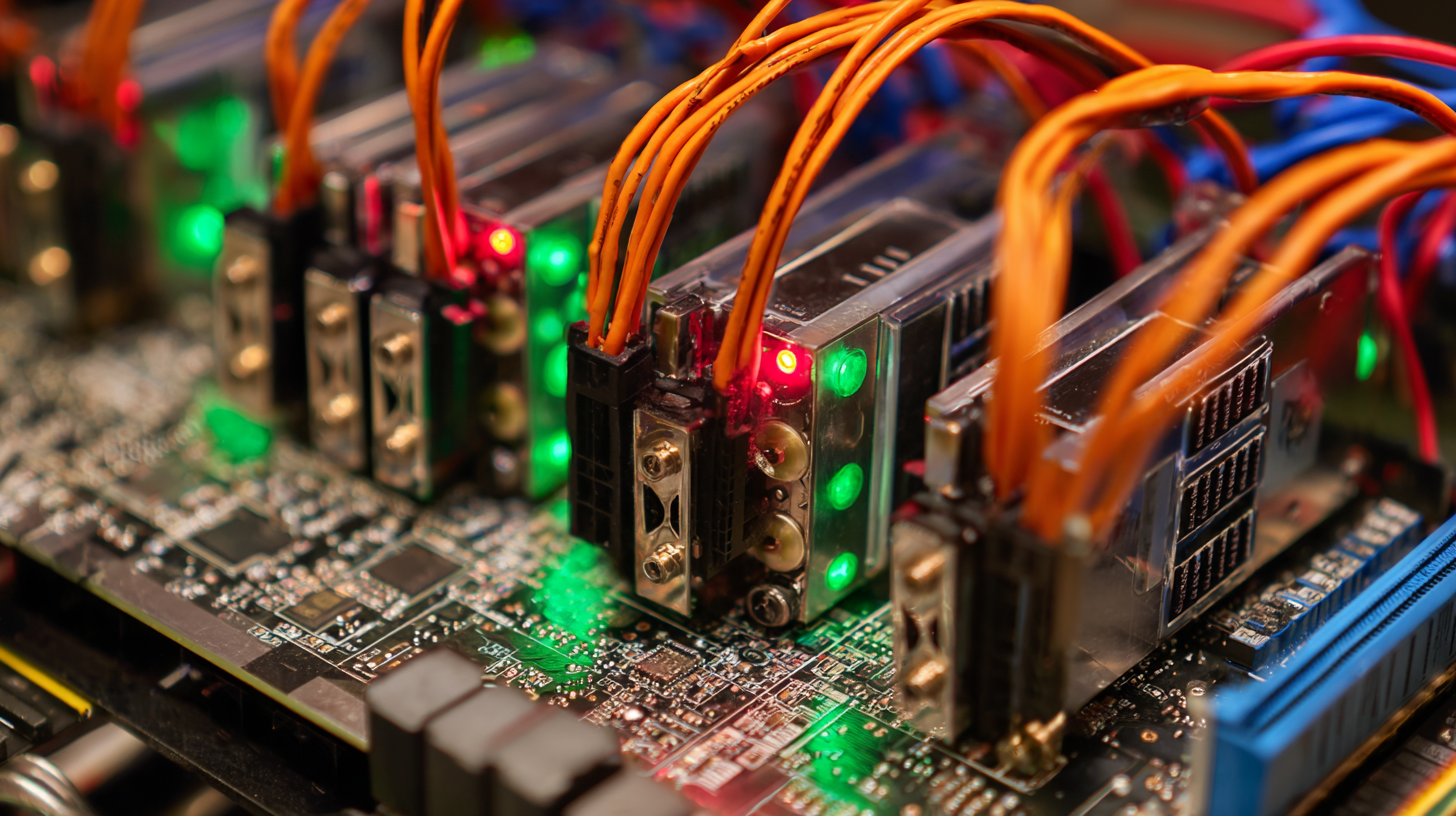

Moreover, the introduction of ASIC mining technology has led to greater network security and stability. With more miners operating powerful ASIC rigs, the hash rate—the total computational power used for mining—has increased substantially. This surge not only makes the mining process more efficient but also enhances the overall integrity of blockchain networks. In a landscape where malicious attacks can threaten the viability of cryptocurrencies, employing ASIC technology fosters a more robust and reliable mining ecosystem, ultimately paving the way for the mainstream adoption of digital currencies.

Key Factors to Consider When Choosing ASIC Mining Hardware

When selecting ASIC mining hardware, there are several key factors that prospective miners need to consider to ensure optimal performance and profitability. First and foremost, hash rate is a critical metric, as it measures the mining rig's performance in solving complex cryptographic puzzles. A higher hash rate generally leads to better chances of successfully mining blocks and earning rewards. Therefore, miners should look for hardware that offers a robust hash rate relative to its price.

Another important aspect is energy efficiency, which plays a significant role in overall operational costs. ASIC miners consume a substantial amount of electricity, so choosing hardware that provides a high hash rate per watt can greatly enhance profitability. Miners should also evaluate the cooling requirements and noise levels of their prospective rigs, as proper cooling is essential for maintaining performance and longevity. Finally, considering the hardware's compatibility with various cryptocurrencies can broaden mining opportunities and mitigate risks associated with market volatility.

These factors collectively empower miners to make informed decisions and maximize their investment in ASIC mining technology.

Future Trends in ASIC Mining Technology and Cryptocurrency

The landscape of cryptocurrency mining is rapidly evolving, largely due to advancements in ASIC (Application-Specific Integrated Circuit) technology. According to a report by CoinDesk Research, the market for ASIC miners is expected to grow by 18% annually through 2025, driven by the increasing demand for efficient mining solutions. ASIC miners are designed to perform a specific task, making them significantly more efficient than general-purpose hardware. This efficiency not only enhances profitability for miners but also decreases energy consumption, addressing some of the environmental concerns associated with cryptocurrency mining.

Future trends in ASIC mining technology suggest even greater specialization and efficiency. Recent developments indicate that next-generation ASIC miners could achieve hash rates exceeding 200TH/s while consuming less than 30J/TH. This shift could lead to a new wave of mining facilities that are not only cheaper to operate but also more environmentally friendly. Moreover, as blockchain networks like Bitcoin continue to adopt enhanced security protocols, the importance of ASIC technology will only increase, making it crucial for miners to stay ahead of the curve in this competitive landscape.

Unlocking the Future of Cryptocurrency with Asic Mining Rig Technology - Future Trends in ASIC Mining Technology and Cryptocurrency

| Trend | Description | Impact on Cryptocurrency | Future Prospects |

|---|---|---|---|

| Energy Efficiency | New ASIC miners are focusing on reducing energy consumption. | Lower operational costs, making mining more profitable. | Continued innovation leading to more sustainable mining practices. |

| Increased Hash Rates | Advancements in chip technology allow for higher hash rates. | Increased network security and competition among miners. | Emerging competition may lead to more decentralized networks. |

| Customization | Miners are now able to customize firmware and hardware. | Allows miners to adapt to changing market conditions. | Potential for specialized pools catering to specific needs. |

| Vertical Integration | Manufacturers are looking to control both hardware and software. | Enhanced performance and user experience. | Emergence of new players in the mining industry. |

| Regulatory Adaptation | Miners are adapting to increasingly stringent regulations. | May affect operational models and investment decisions. | Greater need for compliance-focused solutions. |

Maximizing Profitability: Tips for Optimizing ASIC Mining Performance

In the rapidly evolving world of cryptocurrency, optimizing ASIC mining performance is crucial for maximizing profitability. According to industry reports, factors such as energy consumption, computational efficiency, and hardware selection significantly impact the profitability of mining operations. In 2025, miners must consider not only the latest ASIC mining rigs that offer superior hashing power but also the software tools that can streamline their operations. The best Bitcoin mining software available in 2025 includes advanced features tailored to enhance efficiency and profitability.

Additionally, selecting the right cryptocurrencies to mine is essential. Research indicates that certain digital coins have shown greater returns on investment than others, making them more attractive for miners. For instance, as trends shift, miners are increasingly advised to explore not only Bitcoin but also emerging altcoins that demonstrate promising growth. Staying informed about market conditions, mining difficulty, and hardware performance is key for miners looking to boost their returns in this competitive landscape. By strategically optimizing both hardware and software, miners can unlock the future of cryptocurrency and ensure sustained success.

Related Posts

-

Unleashing Excellence in Global Supply Chains with China's Best Asic Crypto Miner Solutions

-

10 Tips for Choosing the Right Asic Mining Rig to Maximize Your Mining Profits

-

Top 5 Asic Crypto Miner Choices for 2023 with Highest Hash Rates and Best ROI

-

Exploring the Advantages of Cryptocurrency Mining Containers for Optimal Efficiency

-

Ultimate Guide to Selecting the Best Btc Asic Miner for Your Cryptocurrency Needs

-

How to Optimize Your Container Mining Strategy for Maximum Efficiency